IoT Boom Continues: Cellular Connections Generate €14.2 Billion in Revenue

A recent report by Berg Insight shows: Global revenues from cellular-based IoT connections continue to rise – despite declining ARPU. Chinese mobile operators dominate the market, but European and US providers are catching up.

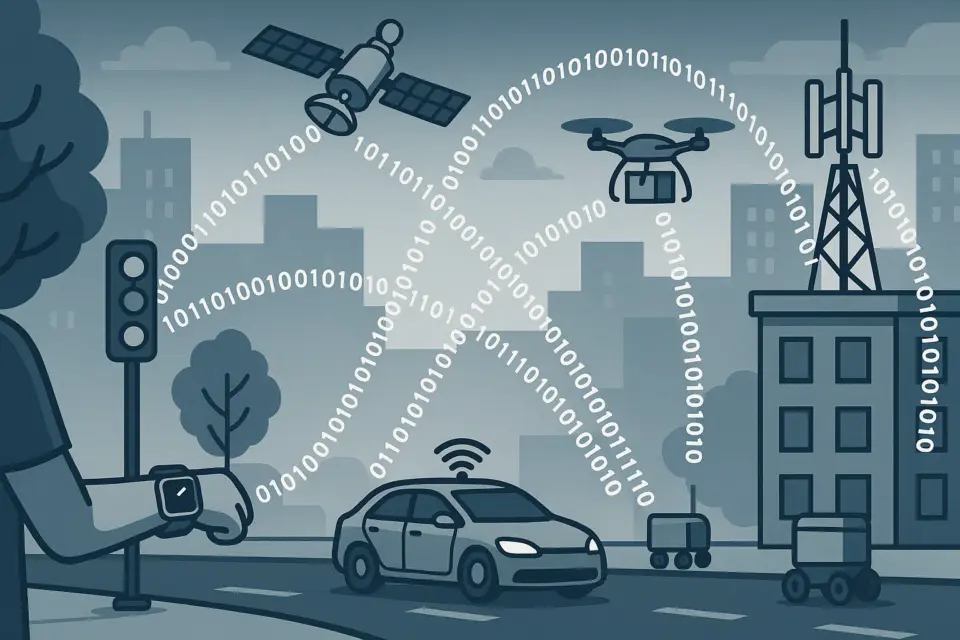

Global IoT market continues to grow

The market for cellular IoT connectivity remains on a growth path. According to a recent analysis by the Swedish market research firm Berg Insight, global revenues from mobile IoT connections reached €14.2 billion in 2024 – an increase of around 12 percent compared to the previous year. At the same time, the average revenue per connection per month (ARPU) fell by 5 percent to €0.33.

Cellular IoT connectivity now accounts for 1 to 4 percent of total service revenues for the world’s largest mobile operators.

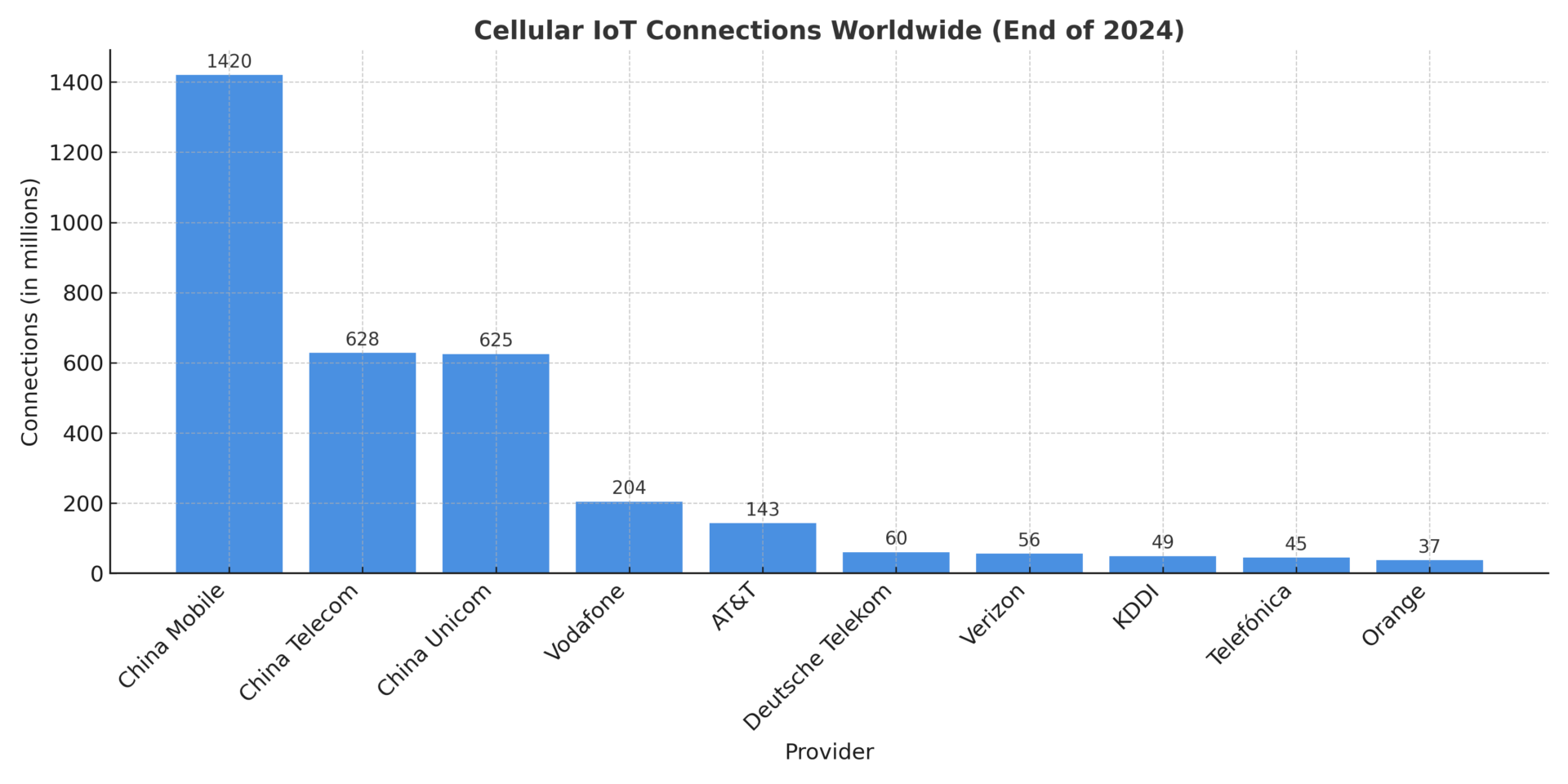

China dominates, but Western providers are gaining ground

With around 3.8 billion active IoT connections worldwide, cellular networking remains one of the key drivers of growth in the Internet of Things. About 86 percent (3.3 billion connections) are concentrated among the top ten providers. Leading the rankings is China Mobile with 1.42 billion IoT connections. Also among the leaders: China Telecom (628 million) and China Unicom (625 million).

As the leading Western provider, Vodafone ranks fourth globally with 204 million connections, followed by AT&T (143 million). Deutsche Telekom and Verizon are in the middle range with around 60 million connections each. Other top-10 players include KDDI, Telefónica, and Orange.

Outlook: 6.4 billion devices by 2029

The outlook remains optimistic: Berg Insight forecasts that by 2029, around 6.4 billion devices will be connected via cellular networks. Annual revenues from connectivity services could then rise to €22.4 billion – despite continued ARPU decline.

Growing importance of IoT service providers

In addition to mobile network operators, IoT Managed Service Providers (MSPs) play an increasingly important role in the ecosystem. These providers – often operating as full MVNOs – combine roaming and local access and often offer vertical-specific value-added services.

Among the best-known players are 1GLOBAL, 1NCE, Aeris, emnify, KORE, Soracom, Telit Cinterion, Velos IoT, and Wireless Logic. By the end of 2024, these service providers managed more than 200 million cellular IoT connections and generated approximately €1.8 billion in annual revenue.

Conclusion

The market for cellular IoT connectivity remains robust: Despite declining margins per connection, overall revenues continue to rise. With increasing device connectivity, ongoing standardization, and new industrial applications, the sector remains a significant growth area – for mobile operators as well as specialized service providers.