China bans NVIDIA to boost domestic AI Chips

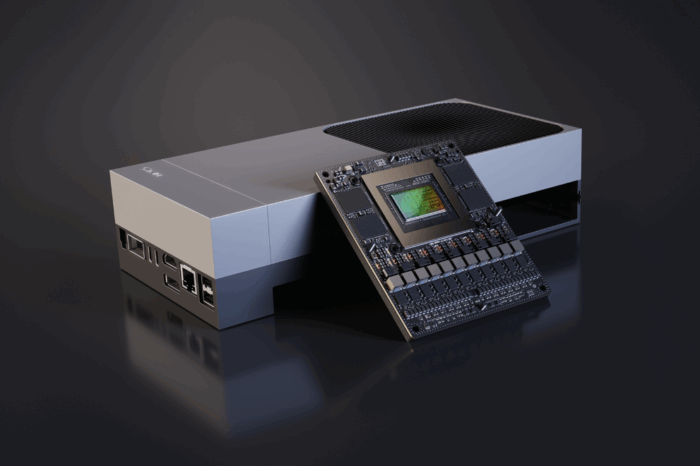

I have just reported about how Chinas Tech Giants challenge NVIDIAs AI Dominance by developing their own chips Now China has taken a decisive step in its race toward technological self-reliance: According to reports from the Financial Times (€), TechCrunch, and others, Beijing has instructed some of its largest technology companies to stop ordering and testing certain NVIDIA artificial intelligence (AI) chips, including the RTX Pro 6000D. This directive, communicated through the Cyberspace Administration of China (CAC), affects companies such as Alibaba and ByteDance and could signal a turning point in the global AI chip industry.

The ban is specific: it applies to the RTX Pro 6000D, a chip that NVIDIA designed—or repurposed—for the Chinese market to comply with U.S. export restrictions. Companies were reportedly told to cancel existing orders and halt ongoing testing. While there has been no official confirmation from Beijing, sources indicate that the CAC framed the decision as a matter of technological sovereignty, arguing that domestic chips have reached performance parity with NVIDIA’s restricted models.

In this article

Regulatory Pressure and Market Dynamics

The move comes alongside another regulatory action: the State Administration for Market Regulation has opened an antitrust investigation into NVIDIA’s acquisition of Mellanox Technologies, alleging violations of Chinese competition law. These parallel developments indicate a broader strategy: limiting foreign dominance while strengthening homegrown industry.

China’s foreign ministry has maintained a softer tone, stating that the country remains open to dialogue and wants to ensure stable supply chains. However, the substance of the directive is clear—China is deliberately pushing its tech giants to reduce reliance on foreign AI chips.

Domestic Alternatives Rise

Chinese firms have been preparing for this moment. Huawei, in particular, has promoted its Ascend line of AI processors, claiming performance metrics that rival or even surpass NVIDIA’s China-specific models. Other players such as Alibaba, Tencent, and Cambricon are also investing heavily in chip development. By declaring local chips “good enough,” the government is signaling to domestic firms and investors that it considers the technological gap largely closed.

For companies like Alibaba, which has already developed its Yitian server chips and is scaling up its AI infrastructure, this policy could accelerate in-house adoption and integration. Firms that lag behind in chip development may be pressured to catch up or partner with domestic manufacturers.

The NVIDIA Dilemma

For NVIDIA, the world’s most valuable semiconductor company, the directive represents a significant setback. China is a critical market for NVIDIA’s AI products, and the RTX Pro 6000D was tailored specifically for the country. Losing access to China’s largest tech firms will not only cut into NVIDIA’s revenues but also undermine its influence in one of the most dynamic AI markets.

NVIDIA may respond with legal challenges, lobbying efforts, or revised product offerings. However, the company faces a larger structural challenge: even compliant, “watered-down” chips may no longer satisfy Beijing’s political and economic priorities.

A Geopolitical Arms Race

This decision cannot be separated from the broader geopolitical rivalry between the U.S. and China over semiconductors and AI. Washington has tightened export controls to prevent China from accessing cutting-edge GPUs needed for large-scale AI training. Beijing’s counter-move—banning foreign chips on its own turf—illustrates the growing bifurcation of the global semiconductor supply chain.

The risk is clear: two parallel ecosystems may emerge. One dominated by NVIDIA, AMD, and other U.S.-allied firms, and another centered around Chinese champions like Huawei and Alibaba. Such a split would increase costs for global companies, reduce interoperability, and potentially slow the pace of AI innovation.

Challenges Ahead for Domestic Players

While the government portrays local AI chips as on par with NVIDIA’s restricted models, technical questions remain. Performance parity in benchmarks does not necessarily translate into equivalent efficiency, reliability, or ecosystem maturity. NVIDIA’s chips benefit from extensive software support, developer tools, and a vast global user base—advantages that Chinese alternatives are still building.

Switching hardware platforms requires not just chip replacement but also adjustments across entire software stacks, training systems, and data center infrastructure. This transition will demand significant resources and may create short-term inefficiencies for Chinese tech firms.

Global Impact

- Market disruption: NVIDIA risks losing billions in potential sales, while Chinese firms could see new revenue streams.

- Investment shift: Venture capital and state subsidies may pour into Chinese AI chipmakers, accelerating their growth.

- Innovation divergence: Separate hardware ecosystems may lead to fragmented AI development paths.

- Regulatory uncertainty: Other governments could follow China’s lead in prioritizing domestic alternatives, reshaping global trade patterns.

Conclusion

China’s order to halt the purchase and testing of NVIDIA’s RTX Pro 6000D is more than a regulatory maneuver—it is a strategic statement. Beijing is signaling that it no longer sees reliance on foreign AI hardware as acceptable, and that its domestic industry is ready to fill the gap. For NVIDIA, this is a direct challenge to its dominance. For Chinese firms, it is both an opportunity and a test: to prove that their chips can truly compete on a global scale.

The outcome will shape not only the future of the AI chip market but also the trajectory of technological competition between the world’s two largest economies.

Summary (tl:dr)

- China has reportedly ordered tech giants to stop buying and testing NVIDIA’s RTX Pro 6000D chip.

- The directive reflects Beijing’s confidence in domestic AI chips from companies like Huawei and Alibaba.

- NVIDIA faces a major loss of market access and influence in China.

- The move underscores escalating U.S.-China rivalry over semiconductors.

- The global chip industry risks fragmentation into parallel ecosystems.