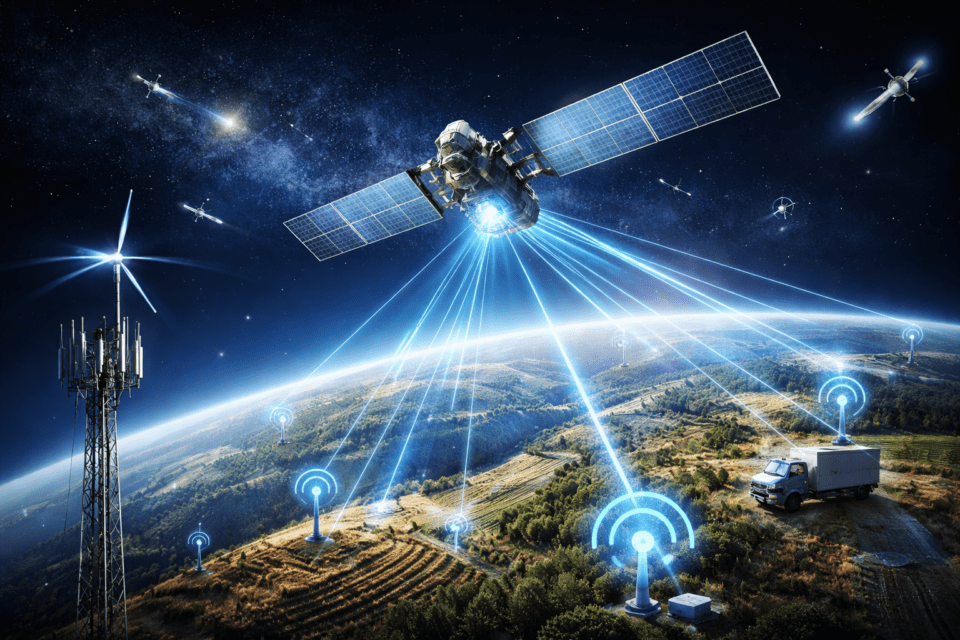

Satellite IoT: From Niche Add-On to a Second Network

Satellite connectivity in IoT was long a specialist tool: great for remote sites, maritime use cases, or research, but too expensive and too self-contained to become a standard option. Since late 2025/early 2026, that has been changing noticeably.

Mobile network operators are increasingly treating satellite IoT as a second network layer alongside NB-IoT/LTE-M and 5G—an insurance policy against coverage gaps and outages. Deutsche Telekom is positioning itself with “multi-orbit” connectivity, combining terrestrial NB-IoT with satellite access via GEO and LEO orbits.

Cellular IoT vs. Satellite IoT

Cellular IoT relies on terrestrial radio networks (NB-IoT, LTE-M): cost-efficient in built-out regions, power-friendly, and operationally tightly integrated with SIM lifecycle, provisioning, billing, and roaming. Satellite IoT shifts the radio link into space: sensors and trackers transmit data to satellites—traditionally via dedicated modules/terminals, and increasingly via radio modules designed for Non-Terrestrial Networks. The upside is coverage and resilience: oceans, mountains, sparsely populated areas, and crisis situations become “reachable” when terrestrial networks are unavailable. The trade-offs are tougher radio conditions (antenna design, line-of-sight), often lower throughput, and—depending on the orbit—different latency and power profiles.

Why the “Second Network” Is Becoming Attractive for Telcos

Two drivers stand out: market growth and rising expectations from industry. IoT Analytics estimated 7.5 million satellite IoT connections for 2024 and forecasts roughly 26% annual growth through 2030 to a market size of more than US$4.7 billion (connectivity and equipment). At the same time, the number of deals is increasing: the GSA counted 170 publicly announced operator–satellite partnerships by August 2025; an update references 225 partnerships across 88 countries and territories by January 2026. For telcos, this is commercially appealing because they can sell satellite capabilities without owning space infrastructure—while retaining the customer relationship, SLAs, and billing within their own portfolio.

3GPP Standardization as an Accelerator

What sets the current wave apart from many earlier, proprietary “island solutions” is standardization. 3GPP Release 17 is the first release to include normative requirements for Non-Terrestrial Networks (NTN) and specification work to enable NB-IoT/eMTC (LTE-M) via satellite. This reduces integration hurdles: core network connectivity, security mechanisms, and device ecosystems can align more closely with cellular logic. In practice, the hybrid model emerges: cellular as the primary path, satellite as the second path.

“Coverage Everywhere” Becomes a Procurement Requirement

In logistics, energy, agriculture, construction, and public safety, IoT is increasingly planned across borders. Anyone offering IoT must be able to explain how trackers, sensors, and meters still function outside terrestrial coverage. Satellite therefore becomes the fallback and gap-filler: infrequent status packets, alarm messages, and heartbeat data when cellular connectivity is not available. That this logic is taking hold in the operator market is also reflected in industry statistics: GSMA Intelligence counted 110 operators/operator groups with active satellite partnerships by the end of September 2025 (67% of the global mobile market by connections).

Who Is Partnering with Whom?

For Deutsche Telekom’s multi-orbit approach, Skylo Technologies, Sateliot, OQ Technology, and Iridium Communications are among those mentioned. Vodafone, meanwhile, argues that LEO constellations are propelling satellite connectivity toward IoT services and points to partnerships and expansion plans in satellite connectivity. In Germany, o2 Telefónica is working with Skylo on hybrid, 3GPP-compliant NB-IoT satellite connectivity. In Sweden, Tele2 launched a commercial, 3GPP-based satellite IoT service with Skylo. And Orange uses Skylo for direct-to-device messaging and has announced an expansion to more devices and enterprise use cases. In the direct-to-cell space, Kyivstar is partnering with Starlink—initially for SMS and, in the longer run, for voice/data.

What Happens to “SIM IoT” Specialists—and What Does It Cost?

For IoT MVNOs and pure SIM connectivity providers, this does not automatically mean the end—but roles are shifting. Global “coverage everywhere” is more likely to become a premium arena for large telcos that integrate satellite as a second network layer into platforms and framework contracts. At the same time, specialists remain attractive when projects are regional, price per device is paramount, or vertical integration (device management, data platforms, rollout services) matters more than worldwide coverage. Many will add satellite as an optional building block via wholesale models—rather than carrying it as their core promise.

On the cost side, satellite IoT typically remains more expensive than terrestrial NB-IoT/LTE-M: modules, certifications, and airtime are pricier, and charging often happens per message or per volume. Economically, it makes sense where satellite transmits only when needed (fallback, alerting, infrequent status packets) and thereby avoids downtime, truck rolls, or lost assets.

“`